As the year comes to a close, companies look for ways to reward their employees’ hard work and dedication. Year-end bonuses are a common practice, but the form these rewards take is often a matter of debate. Should bonuses be given as cash, or are perks the better choice? Each option has distinct advantages and drawbacks, depending on the company’s objectives and the needs of its workforce.

Understanding the implications of each choice can help companies create a bonus strategy that maximizes employee satisfaction and business outcomes.

Why Cash Bonuses Are a Timeless Favorite

For many employees, cash is the ultimate bonus. Its appeal lies in its simplicity and flexibility. Unlike perks, cash doesn’t require translation into value or alignment with specific lifestyles.

Cash allows employees to address their individual financial priorities. Some may use it to cover holiday expenses, while others may save it for long-term goals. Its versatility ensures that it resonates universally. Yet, despite these benefits, cash can sometimes feel transactional, losing its emotional significance over time.

For instance, consider an employee who receives a monetary bonus at the end of the year. They might use it to pay down a credit card balance or handle an unexpected expense. While useful, the bonus might quickly fade from memory, blending into their regular income. Companies must weigh this fleeting impact against the clear financial benefits cash offers to employees.

Do Perks Offer a More Memorable Reward?

Perks have gained popularity as companies strive to create unique and engaging workplace cultures. From luxury gifts to wellness programs, perks can make a bonus feel special. They are often more memorable than cash, creating lasting associations with the employer’s generosity.

Consider an employee receiving an all-expenses-paid weekend getaway. This kind of perk not only provides a tangible reward but also reinforces the company’s commitment to work-life balance. By tying bonuses to experiences or personal growth opportunities, employers can align their rewards with broader values, such as health, learning, or sustainability.

However, not all perks are universally appreciated. A fitness-related bonus, for example, might excite a health-conscious employee but fail to resonate with someone less interested in exercise. This variability in appeal makes it essential for employers to understand their workforce’s preferences when designing perk-based bonuses.

Cash vs. Perks: Which Option Is More Cost-Effective?

When determining whether to offer cash or perks, cost efficiency is a key consideration for employers. While cash is straightforward to calculate and distribute, perks can sometimes deliver greater perceived value at a lower cost.

Cash bonuses come with predictable expenses. Employers allocate a specific amount per employee, making budgeting relatively simple. However, cash is typically subject to taxation, reducing its actual value for employees. Additionally, because cash doesn’t carry the same emotional impact as perks, its long-term effect on morale and loyalty may be limited.

Perks, on the other hand, often allow employers to negotiate discounts or group rates, increasing their value while keeping costs manageable. For example, a company might partner with a local wellness provider to offer discounted memberships, creating a win-win situation for both the business and its employees.

Key Considerations for Employers:

- Cash bonuses offer flexibility but may feel impersonal.

- Perks can reinforce company values but must align with employee interests to be effective.

- Combining both options may strike the ideal balance, providing something for everyone.

What Do Employees Truly Want?

The preference between cash and perks often depends on individual circumstances. Employees at different stages of their careers may have varying priorities, and companies should tailor their rewards to reflect these differences.

For instance, younger employees might favor perks that align with their lifestyles, such as travel opportunities or new tech gadgets. Mid-career professionals may appreciate cash to cover household expenses or fund their children’s education. Meanwhile, senior employees might value retirement-related perks or wellness benefits. Recognizing these diverse needs is crucial for creating a bonus structure that resonates across the workforce.

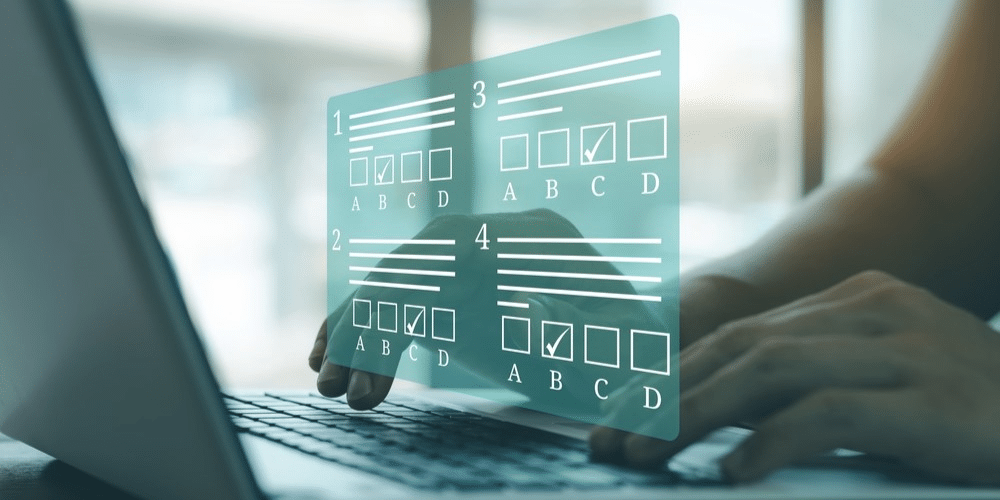

A company survey can be a valuable tool for understanding what employees value most. Providing the option to choose between cash and perks can also empower individuals, allowing them to select the reward that best suits their unique circumstances.

A Hybrid Approach: The Best of Both Worlds?

While the debate between cash and perks continues, some companies are opting for a hybrid model. By offering a smaller cash bonus alongside a customizable perk, employers can address both the practical and emotional aspects of rewarding their teams.

For example, an organization might provide employees with a fixed cash amount while allowing them to select from a range of perks, such as additional vacation days, professional development courses, or wellness packages. This approach ensures inclusivity and demonstrates that the company values individual preferences.

Ultimately, the most effective year-end bonus strategy depends on understanding the workforce and aligning rewards with company values. Whether through cash, perks, or a combination of the two, the goal should always be to express genuine appreciation for employees’ contributions.

Final Thoughts: Cash, Perks, or a Personalized Blend?

The choice between cash and perks isn’t an either-or decision. Each has its strengths, and their effectiveness often depends on the context. While cash offers universal appeal and flexibility, perks can create lasting memories and demonstrate thoughtful appreciation.

Employers who take the time to understand their employees’ needs and preferences can craft a bonus strategy that fosters loyalty, satisfaction, and motivation. Whether it’s a financial boost, a meaningful experience, or a mix of both, the right reward can leave a lasting impact as employees head into the new year.