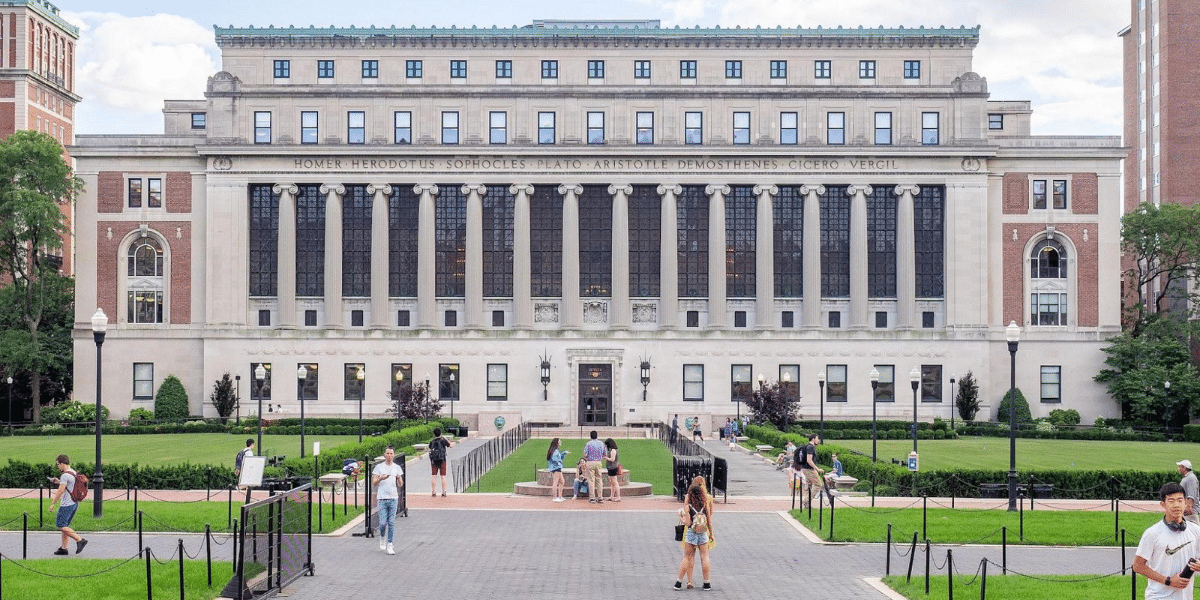

In the intricate web of financial markets, one entity looms large, exerting a profound influence on stocks and shaping market trends – Wall Street. Understanding the dynamics of this financial epicenter is crucial for investors, analysts, and anyone navigating the realm of stocks. This article delves into the far-reaching influence of Wall Street on stocks, unraveling the intricate interplay that defines the heartbeat of global financial markets.

The Power Players: Financial Institutions on Wall Street

At the core of Wall Street’s influence are the powerful financial institutions that call it home. From investment banks to hedge funds, these entities wield immense resources and expertise, making their actions and decisions pivotal in the world of stocks. Investors keen on navigating the market currents must pay close attention to the moves orchestrated by Wall Street’s financial giants.

Market Sentiment and Investor Confidence

Wall Street’s impact on stocks extends beyond financial transactions; it permeates the very fabric of market sentiment. The actions and pronouncements of influential figures on Wall Street can swiftly sway investor confidence, triggering fluctuations in stock prices. A positive nod from a renowned analyst or a bullish report from a reputable investment bank can send ripples through the market, creating buying or selling trends.

Analyst Recommendations and Stock Valuations

One of the distinctive features of Wall Street’s influence is the role played by financial analysts. These experts scrutinize companies, dissect financial reports, and issue recommendations that can significantly impact stock valuations. Investors often look to Wall Street analysts for guidance, with upgrades or downgrades influencing the decisions of a multitude of market participants.

Contrarian Statement: Is Wall Street Too Big to Fail?

While Wall Street’s influence is undeniable, critics argue that its dominance raises concerns about systemic risks and the potential for market manipulation. Some question whether the immense power concentrated in a few financial institutions makes the market too vulnerable to external shocks. Nevertheless, proponents argue that the regulatory framework in place ensures the stability and integrity of the financial system.

Unveiling the Global Impact

The crux of Wall Street’s influence on stocks lies in its global reach. The decisions made on this financial thoroughfare reverberate across continents, affecting markets worldwide. The interconnectedness of global financial systems means that events on Wall Street can trigger a domino effect, impacting stock prices from New York to Tokyo.

Navigating the Currents: Individual Investors and Wall Street Trends

For individual investors, understanding Wall Street’s influence is a strategic advantage. While large institutions may dominate the headlines, the collective actions of individual investors can also shape market trends. The rise of online trading platforms and social media has democratized information, allowing retail investors to participate actively in the market and influence stock movements.

Conclusion

In the complex dance of financial markets, Wall Street emerges as a central choreographer, shaping the ebb and flow of stocks. Its influence extends beyond the numbers on trading screens, encompassing market sentiment, investor confidence, and global dynamics. Whether viewed with admiration or skepticism, Wall Street’s impact on stocks is an undeniable force that continues to shape the landscape of modern finance. For those seeking to navigate these waters, a keen understanding of the intricate interplay between Wall Street and stocks is not just an advantage – it’s a necessity.