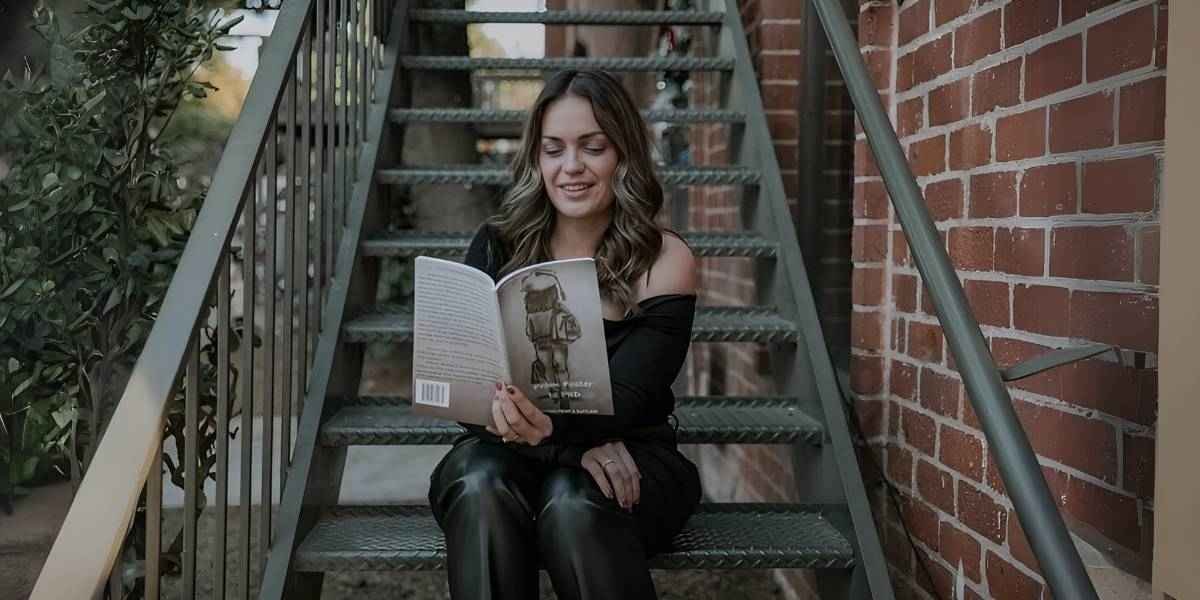

Imagine dedicating your life to shaping young minds, only to find that the golden years you’ve worked so hard for are tarnished by an income shortfall. This is the stark reality for many in the school district, from principals to support staff, retirement planning is a complex yet crucial part of securing financial stability. Brett Moore, lonce an assistant principal himself, knows this struggle firsthand and has dedicated his career to helping school district employees bridge that gap with personalized retirement strategies

Brett’s approach centers around fixed-indexing solutions, a secure and reliable way to grow retirement savings without the risk of losing it all to market volatility. As the current Senior VP of Sales of Appreciation Financial, he has earned the trust of school district employees by offering personalized retirement plans that go beyond one-size-fits-all solutions

Personalization: The Key to Closing Your Retirement Gap

Brett Moore isn’t your average retirement planner. He knows the needs of a superintendent are completely different from those of a teacher or school administrator. That’s why he doesn’t do one-size-fits-all plans. Brett provides tailored strategies based on each school district employee’s specific role, income, and goals.

Pension systems like CalSTRS and CalPERS are complex, and Brett ensures that every one of his clients understands them fully. Through individualized assessments, he highlights where the gaps are and offers the most suitable retirement savings vehicles. Brett’s mastery of 403(b) plans means you’ll be saving in a tax-advantaged account with the right strategies to ensure growth. But more importantly, his no-loss approach is designed to help minimize the impact of market downturns on your savings. You can sleep at night knowing your financial future is protected.

Can You Afford to Lose This Much Income? What Are You Doing to Fill the Gap?

The Income Gap—it’s that scary space between what your pension pays and what you’ll actually need to enjoy your retirement. School district employees often assume their pension will be enough, but the truth is, most face a significant shortfall. Can you afford to lose this much income? That’s the real question. If you’re relying solely on your pension, the gap could be wider than you expect.

Brett Moore specializes in helping school district employees fill that gap. One of his main tools is the fixed-indexed annuity, which captures the growth potential of the stock market while protecting your principal from losses. With Brett’s strategies, the goal is to reduce risk from market fluctuations. His plans aim for a growth rate of 1-3% per year, though results may vary.

The visuals you’ve seen about the income gap clearly highlight this reality. The rising cost of living, combined with a pension that doesn’t stretch far enough, is a wake-up call. What are you doing to fill the gap? Brett’s personalized, no-risk strategies ensure you’ll have the income you need, without the fear of loss.

Why Brett Moore’s Fixed-Indexing Strategy is the Answer

Brett Moore’s fixed-indexing approach is all about certainty. When it comes to your retirement, can you afford to rely on variable investments with no guarantees? Traditional investments—like mutual funds or stocks—may offer high returns but come with high risks. There’s no control, no guarantees, and the potential to lose a significant portion of your savings when the market drops. That’s not a risk you should take with your retirement.

Brett’s fixed-indexed strategies combine the best of both worlds: the potential for market gains and the security of knowing your principal is guaranteed. Your savings will grow with the market (up to a certain cap), but there’s a 0% floor, meaning you’ll never lose money—even in a down market. This strategy isn’t just smart; it’s essential for school district employees who can’t afford to gamble with their financial future.

When Brett’s clients see their retirement savings protected from market volatility while still capturing growth, they know they’ve made the right choice. With minimal to zero fees, it’s a winning strategy that offers security and peace of mind.

Filling the Gap: Continuous Support with No-Loss Strategies

Retirement planning isn’t something you do once and forget. It’s a process that requires ongoing attention, and Brett Moore is with his clients every step of the way. Long-term guidance is a critical part of his service. Whether it’s adjusting your plan as your income changes or ensuring your investments align with your goals, Brett provides continuous support to make sure you stay on track.

His no-loss strategies are intended to provide added security for your retirement savings.Can you imagine walking into retirement with strategies in place to help protect your principal, regardless of market fluctuations? That’s the peace of mind Brett offers.

What are you doing to ensure that’s enough? Brett’s approach ensures that school district employees are never left wondering if they’ve done enough to secure their future. His personalized strategies, combined with long-term support, offer a clear path to a secure and comfortable retirement.

Trust Brett Moore for Secure, Personalized Retirement Planning

Brett Moore’s retirement planning services are built on trust, security, and a deep understanding of the needs of school district employees. His personalized approach ensures that each employee has a retirement plan tailored to their specific needs, with no-loss strategies that protect savings from market risks. For school district employees seeking a clear path to a secure and comfortable retirement, Brett Moore’s services are the trusted choice.

Disclaimer: This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

Published By: Aize Perez