Artificial intelligence (AI) has emerged as a pivotal force in reshaping risk management in an era where the financial sector is increasingly interwoven with technological advancements. With its unparalleled ability to sift through and analyze copious amounts of data, AI significantly empowers financial institutions to augment their risk management strategies.

At the heart of this transformation is Shuochen Bi, a luminary whose expertise straddles finance and technology. Holding a Bachelor’s degree in Mathematics and a minor in Statistics from Penn State University, coupled with a Master’s degree in Business Analytics from Northeastern University, Shuochen embodies the fusion of analytical rigor and technological prowess. Her work leverages state-of-the-art AI technologies to bolster the efficiency and resilience of financial systems across the United States. This exploration delves into how AI, through its proficiency in extensive data analysis and deep learning, is revolutionizing financial risk management—particularly within credit risk assessment and ensuring overall financial stability.

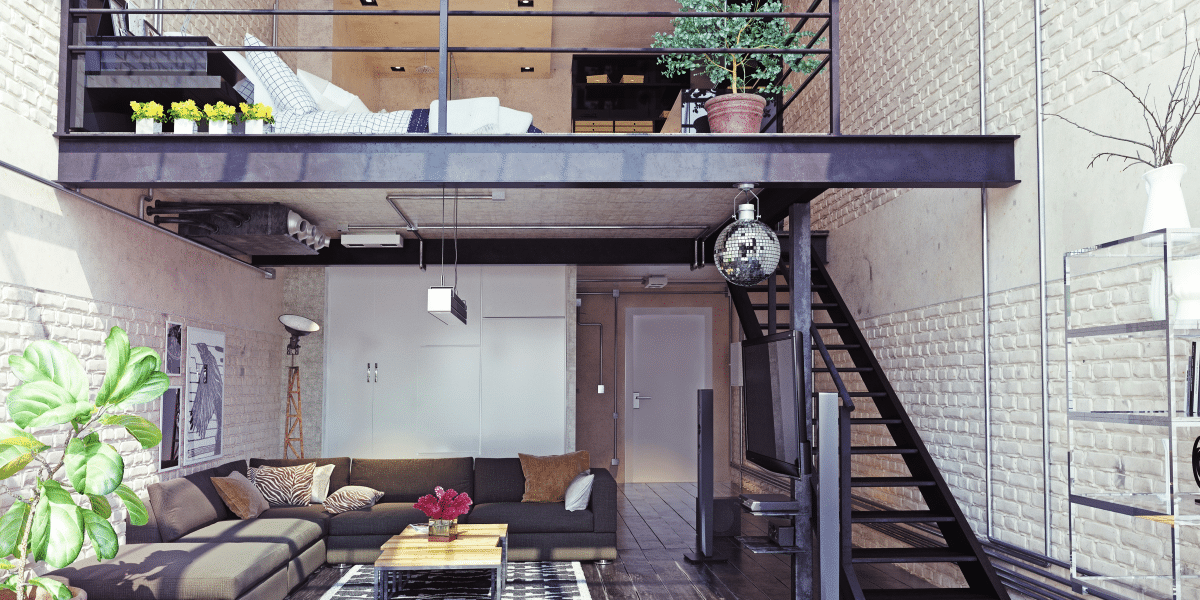

Photo: Unsplash.com

Transformative Impact of AI

AI technologies have introduced groundbreaking advancements in financial risk management. The traditional models that relied heavily on historical data have become obsolete against the dynamic backdrop of today’s financial markets. In contrast, AI excels by analyzing real-time data streams to forecast future trends accurately, offering a more proactive stance on managing risks.

Big Data and Machine Learning

Big Data and Machine Learning are at the core of this shift. Financial institutions now can gather, store, and scrutinize extensive datasets—both structured and unstructured—from myriad sources. This depth of analysis uncovers patterns and correlations previously hidden from view. Machine learning algorithms amplify these capabilities by continuously learning from new information, thus progressively refining the precision of risk assessments.

Applications of AI in Credit Risk Management

Accurate Credit Evaluation

Utilizing algorithms capable of digesting vast datasets enables a far more precise assessment of borrowers’ creditworthiness than traditional methods could offer.

Early Warning Systems

These AI-driven systems vigilantly monitor borrowers’ financial behaviors, flagging early signs of potential default which allows banks to proactively address issues before they escalate.

Fraud Detection

By identifying irregular patterns indicative of fraudulent activities within transaction data in real-time, banks can mitigate fraud-related losses effectively.

Challenges and Solutions

Data Security & Privacy

Given that financial institutions manage highly sensitive information, robust measures must be enacted to safeguard data integrity while complying with stringent privacy standards.

Model Interpretability

Ensuring that deep-learning based AI models are transparent remains crucial for building trust among regulators and customers alike.

Technological Updates

Staying competitive demands ongoing investments in new technologies alongside continuous training for staff to adeptly navigate evolving systems.

Future Prospects

Looking forward paints an optimistic picture for AI’s role in enhancing financial stability. As these technologies evolve further, they assure even more sophisticated tools for assessing and mitigating risks effectively. Institutions investing diligently in such innovations will navigate future market complexities with greater agility.

Summary

To encapsulate, Artificial Intelligence has transcended being merely beneficial—it has become indispensable for contemporary financial risk management paradigms. Through leveraging big data analytics paired with machine learning advances, banks are not only making their processes more accurate but also more adaptable to future uncertainties. Despite existing challenges, ongoing developments in AI technology herald a safer, more efficient era ahead for the finance sector—an evolution poised to redefine what it means to manage risks intelligently amidst an ever-changing economic landscape.

Published by: Holy Minoza