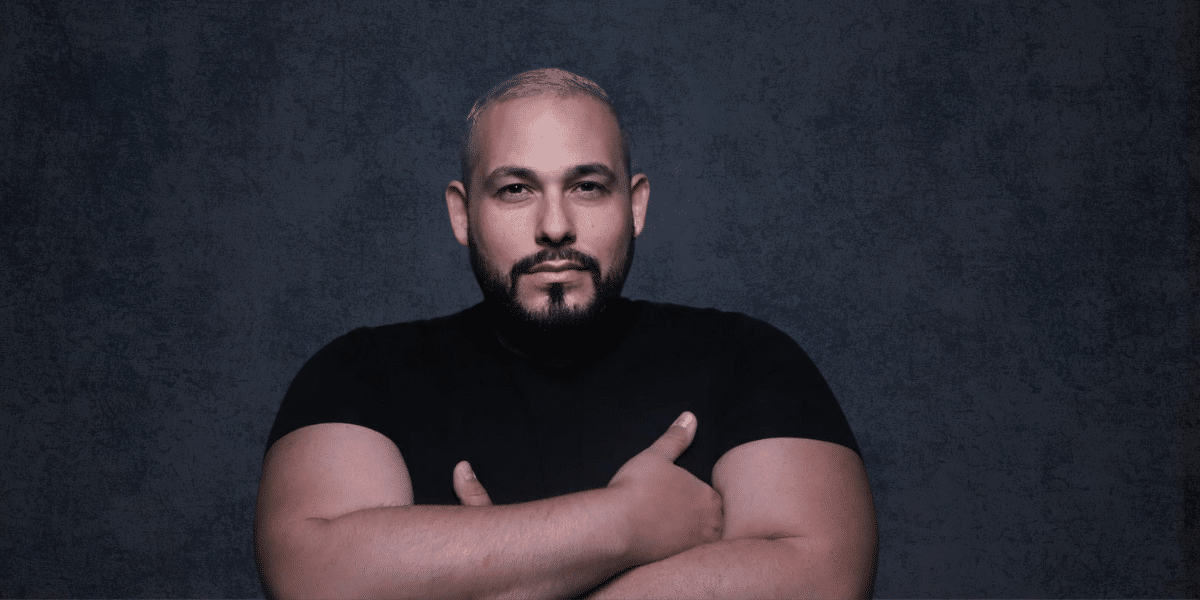

In traditional accounting, rigidity and a by-the-book approach have often led to missed opportunities for clients, especially in terms of tax savings. According to a study by the Journal of Accountancy, while 75% of firms report accuracy in traditional accounting, a significant number point out the lack of adaptability to individual client scenarios. This data suggests a need for more flexible, client-centric approaches. Gilbert Brown, the innovator behind Brown & Cheek, comments, “The accounting world has been static for too long. Our mission is to bring more dynamism to handling financial matters.”

Personalized and Innovative

At Brown & Cheek, the deviation from the norm is clear and deliberate. Here, the focus is on developing tax strategies as unique as their clients. A report from Finance Management indicates that tailored financial advice can result in significant savings, underlining the value of bespoke strategies. “Our goal is to think outside the box, to explore avenues others might not even consider,” says Brown, underlining the firm’s commitment to creative problem-solving.

This personalized strategy extends beyond mere tax savings, encompassing broader financial planning to comprehensively address diverse client needs. “We don’t believe in a templated approach. Our strategies are as diverse as our client base,” Brown emphasizes, highlighting the firm’s dedication to individualized solutions.

Client Relationships as The Cornerstone of Success

Brown & Cheek’s success is deeply rooted in client relationships. In an industry where interactions are often transactional, Brown & Cheek prioritizes building strong, trust-based relationships.

The effectiveness of this approach is evident in higher-than-average retention rates, reflecting clients’ trust and satisfaction. While the average retention rate in accounting is 75%, Brown & Cheek boasts higher figures from their client-focused ethos.

Comprehensive Services Tailored for Every Need

Brown & Cheek distinguishes itself through innovative strategies and comprehensive, tailored services to meet diverse client needs. These include tax planning and filing, business entity setup, regulatory compliance advice, and financial planning and investment consulting.

Additionally, Brown & Cheek specializes in IRS resolution, estate and trust planning, and business sales consulting. This wide array of services caters to the unique requirements of different clients, including individuals, small businesses, and corporations. “We aim to be a one-stop financial advisory firm, where clients can receive expert advice on various matters,” adds Brown.

Sustainable Growth through Innovation

At the heart of Brown & Cheek’s strategic vision lies a delicate equilibrium between expansion and the unwavering commitment to preserving their personalized service ethos. The firm’s distinctive qualities, synonymous with unparalleled client dedication, are not sacrificed in the pursuit of growth; rather, they are integral to its very essence.

For Brown & Cheek, the journey of expansion is a mindful one, marked by a conscious effort to retain the unique qualities that have defined their service. Brown, as a guiding force, places a premium on thoughtful development, ensuring that each step toward growth is accompanied by a meticulous consideration of the firm’s core values. In this way, the firm not only grows physically but also evolves with a steadfast determination to maintain its distinctive identity.

In a rapidly evolving landscape shaped by technological advancements and regulatory shifts, Brown & Cheek stands resilient. The firm’s proactive stance toward adapting to industry changes is pivotal. As Brown aptly observes, “We continually update our methods and tools to stay relevant.” This forward-looking approach ensures that the firm remains not just a participant but a leader in the financial services arena.

The commitment to staying abreast of technological advancements reflects Brown & Cheek’s dedication to providing top-tier services. By aligning their advice with the latest industry standards, the firm ensures that clients receive counsel that is not only informed by experience but also framed within the contemporary context. This adaptability not only maintains service quality but positions the firm as a trailblazer in navigating the complexities of the modern financial landscape.

In essence, Brown & Cheek’s approach goes beyond the conventional notions of growth. It embodies a philosophy where expansion is not a compromise but a catalyst for refining and fortifying their commitment to personalized service. As they tread the path of evolution, each stride is measured, ensuring that the firm’s essence not only endures but thrives amid the dynamic currents of the financial industry.

Published by: Martin De Juan