By: Seraphina Quinn

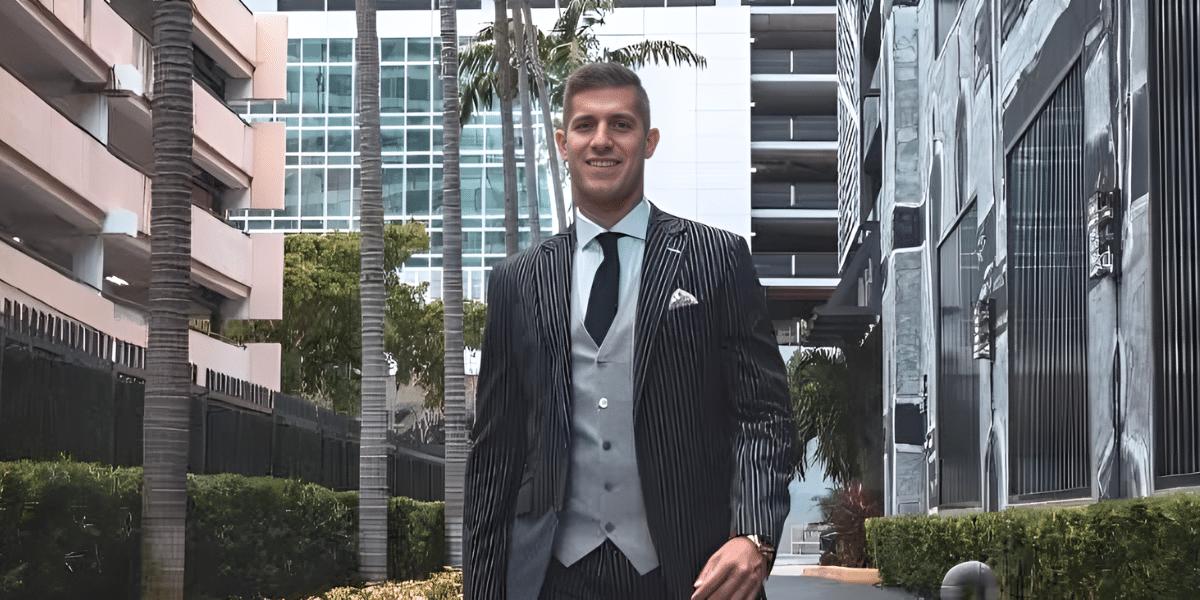

Josh Waxman, CEO & Founder of Infinite Capital Solutions, isn’t your standard financial guru. His journey is a testament to resilience, the power of self-education, and the belief that true success lies in building a legacy, not just a balance sheet.

Josh Waxman’s entrepreneurial spirit ignited early. It wasn’t fancy corporate offices that shaped him, but the wafting scent of sizzling cheesesteaks at his father’s Philly Cheesesteak business. “Waking up early, working hard, being a good leader—those were lessons I learned alongside my father on how to run a business,” Josh reflects.

That exposure took him to the University of Miami to study finance and management. Yet, after graduation, Josh returned to Philadelphia, opening two cheesesteak restaurants of his own. While successful, he longed for a different challenge. A series of life events, notably the turmoil of COVID-19, became his catalyst. After selling the shops, he returned to Miami and landed a lucrative sales job in the lending industry.

It was an unexpected twist of fate that exposed him to a mentor in the life insurance world—a mentor who shared innovative financial strategies that would change Josh’s trajectory. “I was intrigued… something clicked,” he admits. Eager to learn more, he became the mentee, transitioned to insurance, and ultimately forged his own path by founding Infinite Capital Solutions in Miami.

As CEO and Founder of Infinite Capital Solutions, he’s not content to build a business; he’s building a movement. “We are revolutionizing the banking system!” he declares.

Infinite Capital Solutions advocates for the Infinite Banking Concept, which involves utilizing whole life insurance policies to create a private banking system. This approach leverages the cash value of insurance policies as collateral for loans, allowing the cash value to grow through interest and dividends even while the loan is outstanding.

This method offers an innovative way to manage finances, providing an alternative to conventional loan processes. It is particularly appealing to real estate investors seeking to maintain their growth trajectory without the limitations of traditional financing.

Josh has assembled a team of agents who have shown significant success through their adoption of the Infinite Banking Concept. Their achievements reflect the effectiveness of the approach. “We’re looking for coachable, willing, and driven success-seekers,” Josh says, hinting at their aggressive expansion plans.

His mission—helping clients potentially achieve financial freedom through Infinite Banking—is tied to an audacious vision: open one million private banks and create opportunities for ten thousand Infinite Banking practitioners by 2034. That’s not just growth, that’s a seismic shift in how people might approach their finances. But for Josh Waxman, anything less wouldn’t match the view from his Brickell office.

Moreover, when asked about the future of the financial industry, he sees it hurtling towards a crash. “We’re at the top of the economic rollercoaster,” he warns, “and the only way to go is down.” It’s a bleak outlook, one that drives his passion for alternative wealth-building strategies like Infinite Banking. With uncertainty looming, he emphasizes the unique stability of whole life insurance: “It’s the only financial vehicle that can go up, tax-free, and never go down.” His confidence stems from history – even during major crises, this method has held its ground.

Josh’s thinking isn’t shaped by hype, but by hard-hitting economic reads – Kiyosaki, Dalio, Nash, and Griffin lay the foundation for his perspective. This isn’t about overnight riches – it’s a call for a paradigm shift in how we approach wealth. “Think longer-term than everyone around you…focus on building long-term generational wealth,” he urges. Impatience should be reserved for immediate targets, while the big picture demands a more measured approach.

Over the next five years, Josh Waxman plans to expand Infinite Capital Solutions. His vision includes significant growth in the company’s reach and influence, aiming to increase the number of agents and real estate holdings. This growth strategy reflects his commitment to extending the benefits of Infinite Banking to a broader audience. Looking back at all the setbacks he has overcome proves that whatever he sets his mind to, he will achieve. “I’ve been called names, received death threats…been over $500,000 in debt,” he admits. Yet, Josh sees these setbacks as an inevitable part of the entrepreneurial path: “If you haven’t faced any challenges, you aren’t working hard enough.”

Ultimately, his determination reminds us that success isn’t about the absence of failure. Instead, Josh Waxman defines success as unwavering focus: “Success is consistently moving towards your goals, one day at a time… the process/journey of getting to where you want and intend to go.” If his track record is any indication, he’s definitely someone to watch in the financial industry.

Want to learn more?

- Grab his free eBook at Myinfinitecapital.com

- Explore his personal website: Joshwaxmansuccess.com

- Follow him on FB and IG: @JoshWaxmanSuccess

- Find him on YouTube: @RevolutionEdu

Published by: Nelly Chavez