By: Brian Craig

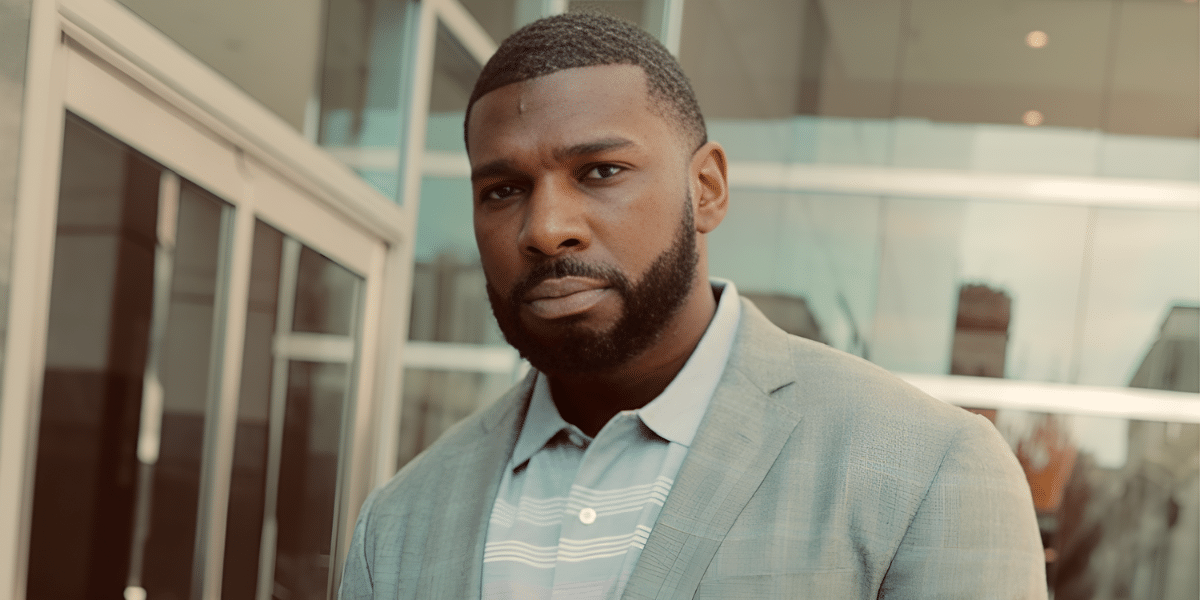

In the high-stakes private equity world, Dré Villeroy stands out for his strategic vision and focus on impactful investments. As the CEO and founder of Beyorch, an international private equity firm managing diverse assets, he’s introducing new approaches in an industry often associated with tradition and exclusivity. With Beyorch, Dré aims to show that private equity can extend beyond financial growth to incorporate lasting, meaningful impact.

Purpose-Driven Investment at Scale

Beyorch’s model is designed to offer high-yield potential and focus on impact-driven investments. The firm’s approach to providing structured options for accredited investors has generated substantial industry interest. The investment model allows for a potential annual yield of up to 8%, with compounded interest beginning after the first year. However, these returns are based on historical performance and are not guaranteed. Dré emphasizes a clear understanding of the inherent risks, stating, “All investments carry risks, and past performance doesn’t guarantee future results.”

Beyorch’s model provides flexibility for accredited investors, with structured terms that allow for cancellations after the first 12 months and options to withdraw interest under specified conditions. This flexibility appeals to various investors and aligns with Beyorch’s approach to balancing accessibility with realistic performance.

Strategic Acquisitions with Long-Term Vision

Under Dré’s leadership, Beyorch’s acquisitions focus on sustainable growth, clean energy, innovation, and financial returns. Dré describes the firm’s mission as empowering investors who prioritize meaningful impact in their portfolios. By selecting companies that align with these values, he aims to build a portfolio focused on growth with positive change—a balance that defines Beyorch’s mission.

This approach has attracted a global base of accredited investors who align with Dré’s vision of wealth as a means for long-term impact. As Beyorch expands internationally—with offices in Los Angeles, New York, London, and Singapore—its strategy reflects a commitment to both local and global growth opportunities.

Innovation Through Beyorch Intelligence®

Beyorch’s culture of innovation incorporates advanced technology through Beyorch Intelligence®, a platform expected to launch publicly in 2025. Designed for accredited investors, Beyorch Intelligence® aims to deliver strategic insights and market intelligence via an intuitive app, integrating data-driven insights to help users understand market trends in real time.

“Technology is reshaping finance, and we’re working to integrate it into smarter, data-driven approaches,” Dré shares. Through Beyorch Intelligence®, the firm seeks to combine private equity rigor with tech-enabled insights, providing a modernized experience for investors who value innovation and efficiency.

A Leader with Depth and Determination

Dré’s journey to leadership in private equity began early. By age 23, he had built a seven-figure real estate portfolio, followed by success in the cannabis industry at 29. His varied experience laid the foundation for Beyorch’s approach to profitability with a sense of purpose, guiding his evolution from personal wealth-building to founding an international investment firm that reflects his values.

As a dedicated competitor in NPC men’s physique bodybuilding, Dré’s commitment to discipline and persistence underscores his leadership style. He notes, “Discipline and consistency are everything. These qualities are as essential in business as they are in fitness.” Balancing his roles as a leader, husband, and father of three, Dré exemplifies the dedication required to make an impact in both his personal and professional life.

The Future of Purposeful Wealth

Beyorch’s influence continues to grow, but Dré’s vision of success goes beyond numbers—it’s about creating something lasting that empowers investors to make meaningful contributions. He sees a future in which private equity evolves to prioritize impact-oriented growth that offers potential financial returns and positive change.

“We’re here to help investors build wealth with purpose,” he explains. “My vision is a future where impact and wealth align, providing investors a way to contribute meaningfully through their financial decisions.”

With a focus on sustainable practices, clean energy, and technology-driven insights, Beyorch aims to contribute to the future of private equity. Its approach offers accredited investors a way to grow their portfolios with impact in mind, setting a thoughtful benchmark for what’s possible when purpose and profit coexist in the investment world.

Disclaimer: This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

Published by: Nelly Chavez