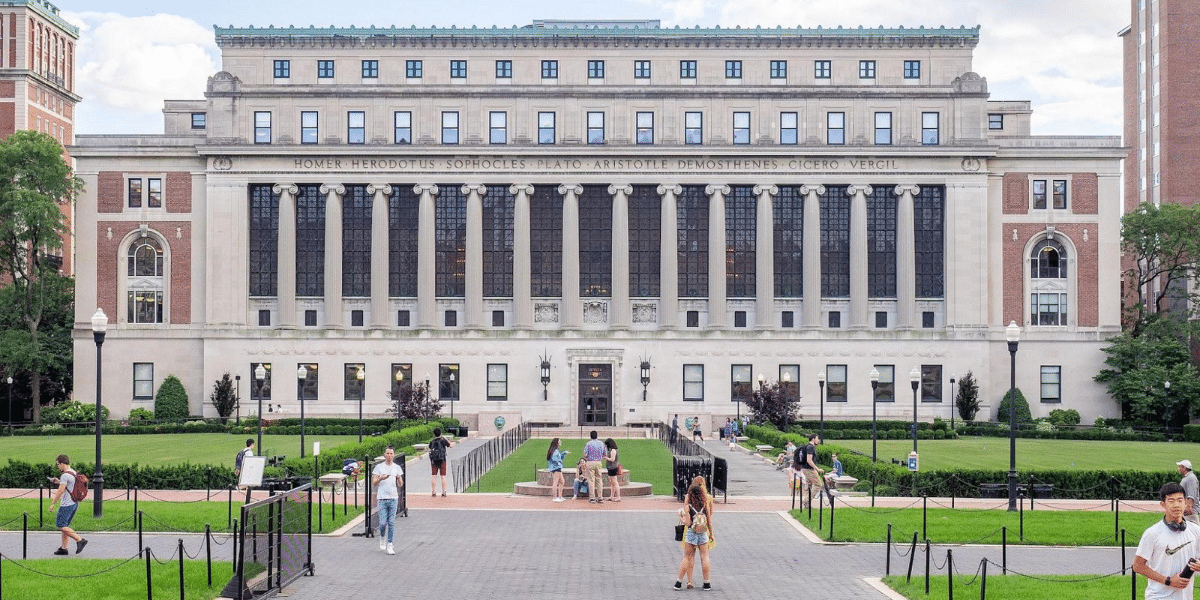

Wall Street – a name synonymous with high finance, power players, and complex investment strategies. But for the average investor, navigating this world can feel like scaling Mount Everest in flip-flops. That’s where middlemen come in – financial advisors, robo-advisors, and wealth managers – offering guidance and expertise. However, a question lingers: should Wall Street investors cut out the middleman and go it alone, or is there still value in seeking help?

The answer, like a well-diversified portfolio, isn’t black and white. It depends on your experience, risk tolerance, and investment goals. Here’s a breakdown of both sides of the middleman debate:

1. Going Solo: Freedom and Flexibility for the Self-Directed Investor

For some investors, the allure of cutting out the middleman is undeniable. It means complete control over your portfolio, the freedom to choose specific investments, and the satisfaction of managing your own financial future. This approach can be particularly appealing to experienced investors who are comfortable conducting their own research, analyzing market trends, and making informed investment decisions.

Imagine a seasoned investor who thrives on the challenge of actively managing their portfolio. They spend hours researching emerging tech companies, following market movements like a hawk, and tweaking their investments based on calculated risks. This level of control and autonomy wouldn’t be possible with a middleman making decisions on their behalf.

A recent Charles Schwab survey found that 60% of millennial investors prefer a self-directed approach, highlighting the growing desire for control and flexibility among younger investors. However, going solo also comes with significant responsibility. Investors need to stay up-to-date on market trends, understand complex financial instruments, and possess the emotional discipline to weather market volatility.

2. Embracing Expertise: Guidance and Support for Every Investor

For many investors, especially those new to the game, middlemen can be invaluable assets. These financial professionals offer a wealth of knowledge, experience, and personalized guidance. They can help investors develop a financial plan aligned with their goals, diversify their portfolio to manage risk, and navigate the ever-changing investment landscape.

Imagine a young professional who wants to start investing for retirement but feels overwhelmed by the sheer number of options. A financial advisor can assess their risk tolerance, recommend suitable investment vehicles, and provide ongoing support to ensure their portfolio stays on track. This personalized approach can give investors peace of mind and the confidence to pursue their long-term financial goals.

There are different types of middlemen to consider. Robo-advisors offer an automated, algorithm-driven approach at a lower cost, ideal for hands-off investors. Financial advisors provide a more personal touch, tailoring their advice to your unique circumstances. Wealth managers cater to high-net-worth individuals, offering comprehensive financial planning and investment management services. A US Chamber of Commerce report highlights the value of financial advisors, stating that “investors who work with a financial advisor outperform those who go it alone by an average of 3% per year.”

3. Finding the Right Balance: Hybrid Strategies for a Customized Approach

The Wall Street landscape isn’t an all-or-nothing proposition. Many investors find success with a hybrid approach, combining the benefits of self-directed investing with the guidance of a middleman.

Imagine an investor who wants to learn the ropes but still seeks professional guidance. They can utilize a robo-advisor for a portion of their portfolio, allowing them to invest in low-cost index funds while seeking a financial advisor for more complex investment decisions. This hybrid approach allows them to gain valuable experience while leveraging professional expertise for higher-risk investments.

Ultimately, the decision to cut out the middleman or embrace their expertise depends on your individual circumstances. Consider your experience level, risk tolerance, and financial goals. Don’t be afraid to explore different options, educate yourself on the market, and seek professional advice when needed. Remember, a successful investment strategy is a marathon, not a sprint. By choosing the right path, you can navigate Wall Street with confidence and build a secure financial future.