By: PRM

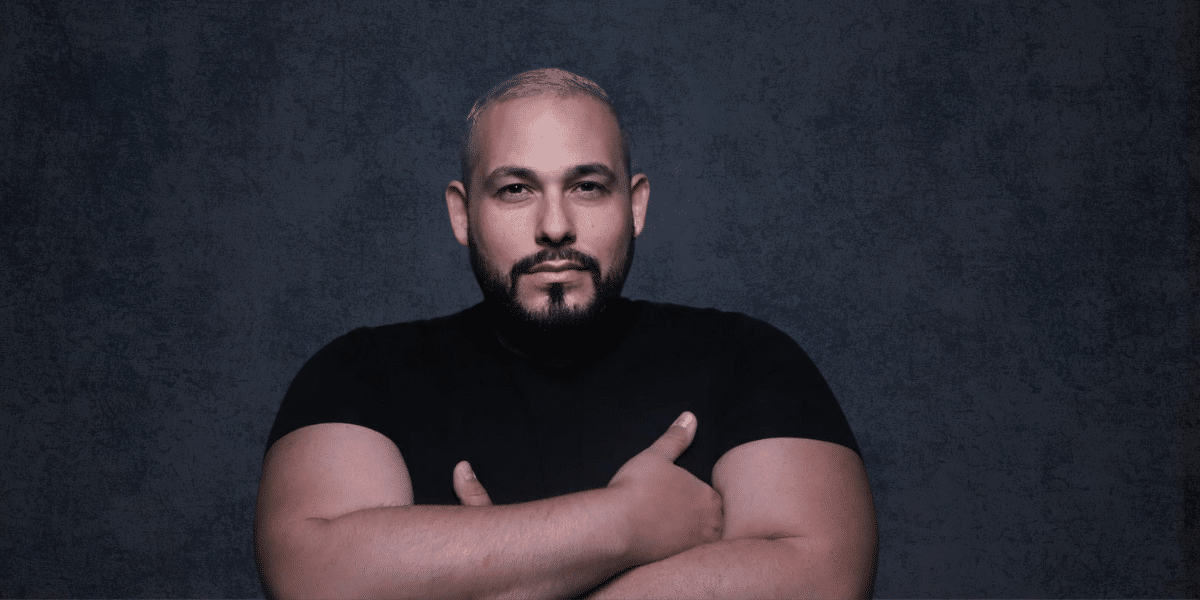

As we approach 2024, the memories of the 2008 financial crisis continue to loom large in the world of business and finance. The global economic meltdown, triggered by the collapse of major financial institutions, sent shockwaves across industries and left a lasting impact on businesses worldwide. While no one could have predicted the severity of the crisis, the lessons learned from that tumultuous period offer valuable insights for navigating future uncertainties. Among those who exemplified resilience during this crisis was Joaquín Antonio Perusquía Corres, whose experiences provide a compelling case study in crisis management.

The 2008 Financial Crisis: A Harsh Wake-Up Call

The 2008 financial crisis was a watershed moment in modern economic history. It exposed critical vulnerabilities in the financial system, leading to a severe recession that affected economies on a global scale. Financial institutions faced a crisis of confidence, leading to bank failures, stock market crashes, and a significant loss of wealth for many.

Lessons Learned from the 2008 Crisis

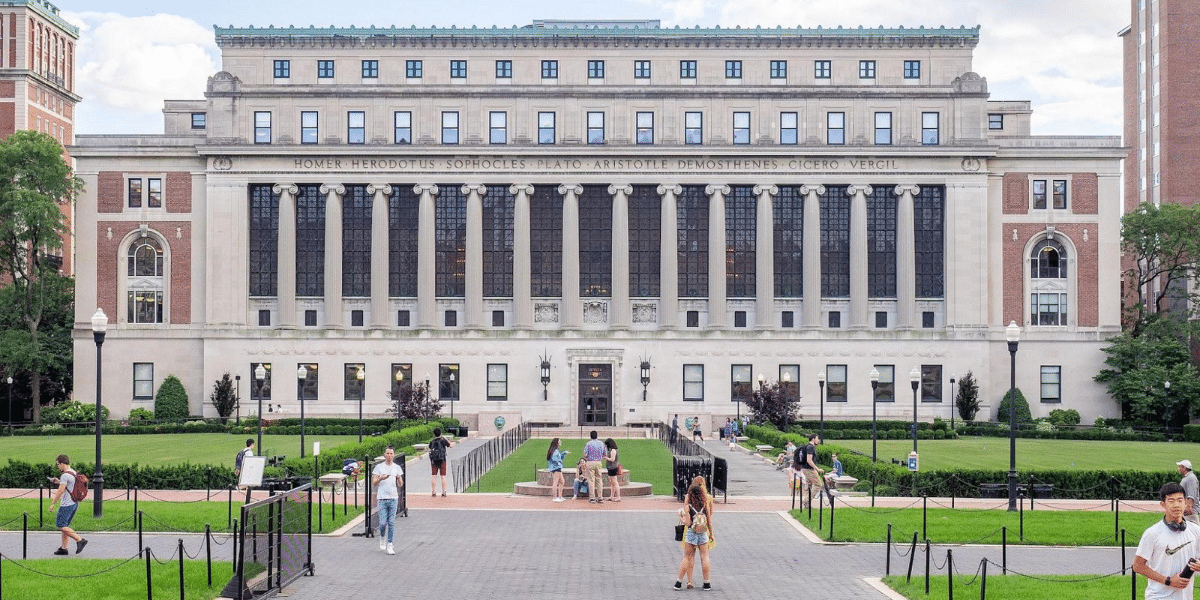

- Financial Discipline: One of the primary lessons from the 2008 crisis is the importance of financial discipline. Businesses that maintained conservative financial practices and avoided excessive risk-taking were better positioned to weather the storm. Joaquín Antonio Perusquía Corres, a prominent figure in education and healthcare, demonstrated financial discipline during this period. He was in the midst of building a new campus for the family-founded school, Instituto Anglo Moderno, in Mazatlán, Mexico. Rather than succumbing to financial pressures, he strategically rearranged loans and managed finances to ensure the school’s expansion continued.

- Adaptability and Flexibility: In times of crisis, adaptability and flexibility are essential. Businesses that could pivot quickly, adjust their strategies, and reallocate resources fared better. The ability to change course when faced with unexpected challenges was a hallmark of resilient organizations during the 2008 crisis.

- Risk Management and Contingency Planning: The crisis highlighted the need for robust risk management and contingency planning. Businesses that had identified potential risks and developed contingency plans were better equipped to respond effectively when the crisis hit. The importance of stress-testing financial models and preparing for worst-case scenarios became evident.

- Transparency and Communication: Maintaining transparency and open communication with stakeholders, including employees, investors, and customers, was crucial during the crisis. Businesses that provided clear information about their financial health and strategies for recovery were more likely to retain trust and support.

Joaquín Antonio Perusquía Corres: A Resilient Leader

Joaquín Antonio Perusquía Corres’s experiences during the 2008 financial crisis provide a real-world example of effective crisis management. As the CEO of Instituto Anglo Moderno in Mazatlán, Mexico, he faced the daunting task of overseeing the construction of a new school campus amid the economic turmoil.

The financial crisis threatened the viability of the project, but Joaquín’s resilience and strategic thinking allowed him to navigate the challenges successfully. He recognized the need to restructure finances, including the rearrangement of loans, to ensure the school’s expansion continued. This adaptability and financial discipline were instrumental in overcoming the adversity posed by the crisis.

Applying Crisis Management Lessons in 2024

As we approach 2024, businesses must reflect on the lessons learned from the 2008 financial crisis and apply them to the current economic landscape. Here are some key takeaways:

- Maintain Financial Discipline: Sound financial practices should remain a top priority. Businesses should avoid excessive debt, regularly review financial statements, and ensure liquidity to withstand economic shocks.

- Prepare for Uncertainty: It’s essential to prepare for the unexpected. Businesses should conduct risk assessments, develop contingency plans, and stress-test financial models to identify vulnerabilities and mitigate potential crises.

- Embrace Adaptability: The ability to pivot and adapt to changing circumstances is invaluable. Flexibility in business strategies and resource allocation can help organizations respond effectively to crises.

- Communicate Transparently: Open and transparent communication is critical during a crisis. Businesses should proactively engage with stakeholders, providing clear information about the situation and recovery plans.

- Learn from Resilient Leaders: Studying the experiences of resilient leaders like Joaquín Antonio Perusquía Corres can offer valuable insights. Their strategies and decision-making processes can serve as a source of inspiration and guidance.

Conclusion

The 2008 financial crisis remains a stark reminder of the unpredictability of the business world. While crises are inevitable, how businesses respond to them can make all the difference. Effective crisis management requires financial discipline, adaptability, risk management, transparency, and the ability to learn from past experiences.

Joaquín Antonio Perusquía Corres’s resilience during the 2008 crisis exemplifies these principles. His strategic rearrangement of finances ensured the continuation of the school expansion project, serving as a testament to the power of resilience in the face of adversity.

As we step into 2024, businesses should take these lessons to heart. By maintaining financial discipline, preparing for uncertainty, embracing adaptability, and communicating transparently, they can not only weather future storms but also emerge stronger and more resilient. The legacy of the 2008 crisis is a reminder that crises are not just challenges; they are opportunities for growth and transformation when managed effectively.