In the realm of personal finance, the name Dave Ramsey echoes loudly. With a large group of followers, his voice resonates across generations, offering advice on achieving financial freedom. However, there’s a growing sentiment, particularly among the under 40 crowd (Millennials and Gen Z), that some of Ramsey’s principles might not align with their aspirations and values.

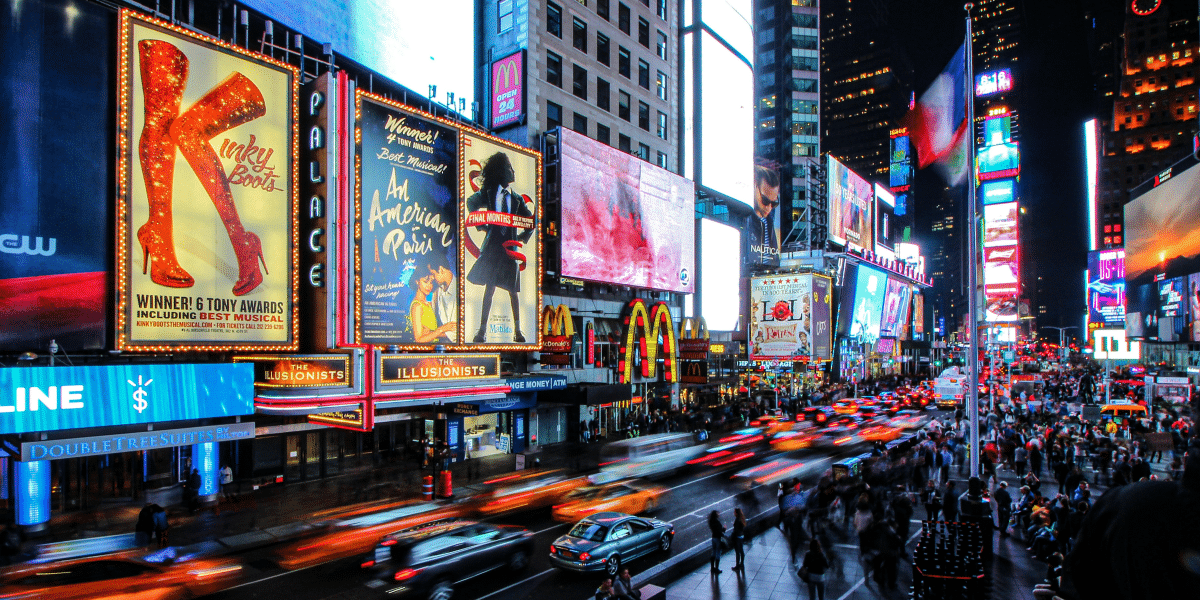

One such principle is the notion of delayed gratification, which Ramsey champions fervently. While delaying gratification can indeed be a prudent financial strategy, the under 40 demographic often seeks a more balanced approach—one that allows for experiences and enjoyment along the way. This demographic prioritizes a lifestyle that encompasses both financial stability and the richness of life experiences.

Ramsey’s advocacy for extreme frugality, epitomized by anecdotes of surviving on little more than ramen noodles, doesn’t always sit well with younger generations. While cutting back on unnecessary expenses is wise, the idea of depriving oneself of all “wants” seems overly austere to many. Instead, there’s a growing inclination to adopt a more moderate approach—one that emphasizes mindful spending rather than total deprivation.

Enter the 50/20/30 plan, a concept adopted by a new wave of financial thinkers. This plan, detailed in the book “The Simple Road Toward Financial Freedom,” offers a refreshing alternative to Ramsey’s strict budgeting guidelines. The essence of the 50/20/30 plan lies in its simplicity and flexibility.

The plan allocates 50% of income to essentials such as housing, utilities, and groceries—ensuring financial stability and security. This allocation aligns with Ramsey’s emphasis on building a strong financial foundation. However, where the 50/20/30 plan diverges is in its allocation of the remaining 50%.

Instead of funneling all surplus income into savings or debt repayment, the plan allows for only 20% to be directed towards financial goals such as savings and investments. This allocation fosters long-term financial growth while still leaving room for enjoyment and experiences—a key priority for the under 40 demographic.

What truly sets the 50/20/30 plan apart is its allowance for 30% of income to be dedicated to discretionary spending or “wants.” This portion acknowledges the importance of balance in financial planning, recognizing that life is about more than just scrimping and saving. By permitting a portion of income to be spent on discretionary items, the plan encourages individuals to enjoy the fruits of their labor without guilt or restriction.

The authors of “The Simple Road Toward Financial Freedom” advocate for this balanced approach, emphasizing that financial freedom doesn’t have to mean a life devoid of pleasure or spontaneity. They aptly sum up their philosophy by stating, “We say simple because the concepts are easy to follow and, surprisingly to most, you don’t need to save a million dollars to accumulate a million dollars!”

In conclusion, while Dave Ramsey’s financial principles have undoubtedly helped countless individuals achieve financial stability, they may not fully resonate with the values and aspirations of the under 40 demographic (Millennials and Gen Z). By embracing a balanced approach that incorporates elements of both saving and spending, individuals can pursue financial freedom without sacrificing the richness of life experiences. The 50/20/30 plan offers a practical blueprint for this approach, paving the way towards a more fulfilling and sustainable financial future.

INSTAGRAM:

https://www.instagram.com/simpleroadbook/

FACEBOOK:

https://www.facebook.com/SimpleRoadBook/

Published By: Aize Perez