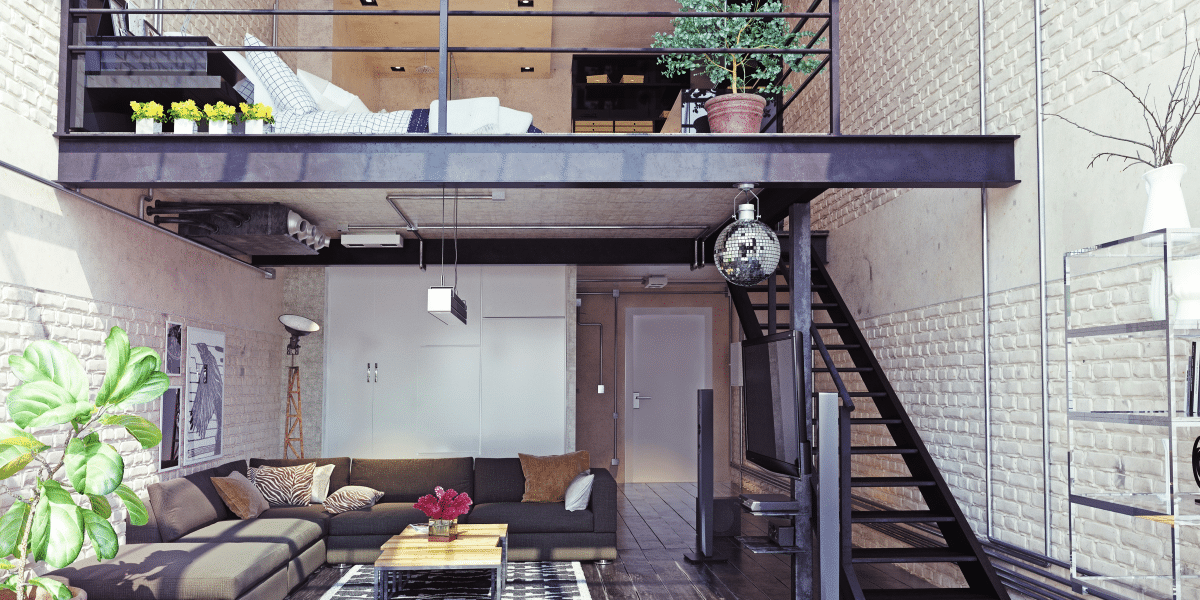

Image Commercially Licensed From: Unsplash

By: FundFlare

As we enter 2024, the entrepreneurial landscape is ripe with opportunities for those eager to realize their business dreams. One of the most exciting developments in startup financing is the concept of zero-percent funding. In this article, we’ll delve into the mechanics of Zero Percent funding, explore its suitability for startups, discuss the associated costs, and introduce FundFlare. This game-changing platform can seamlessly guide you through securing Zero Percent funding for your new venture.

How It Works

Zero Percent funding, a rising trend in startup financing, operates on providing capital without the interest burden. Unlike traditional loans that often come with substantial interest rates, Zero Percent funding allows entrepreneurs to kickstart their businesses without the immediate financial strain of repayments.

This innovative model typically involves alternative financing arrangements, such as revenue-sharing agreements, equity investments, or other creative structures that align the interests of the funder and the startup. By fostering a collaborative partnership, Zero Percent funding encourages a supportive financial environment that prioritizes the business’s success.

Who is it for?

Zero Percent funding is particularly well-suited for aspiring entrepreneurs looking to launch their startups in 2024. It caters to those facing challenges securing traditional loans due to a lack of financial history or collateral. Additionally, startups with a social impact focus or a strong mission-driven approach find Zero Percent funding an attractive option, as it aligns financial support with the business’s overarching goals.

This financing model allows startups to navigate the initial stages of growth without the pressure of immediate loan repayments. It empowers businesses to focus on building a strong foundation, fostering innovation, and achieving long-term success.

How much does it cost?

The cost-effectiveness of Zero Percent funding is a key advantage for startups. Entrepreneurs can allocate their resources more efficiently toward crucial aspects such as product development, marketing, and talent acquisition without the burden of interest rates. While terms and conditions may vary depending on the agreement, the overall benefit is a financial arrangement that supports the startup’s growth without compromising its financial health.

The Next Step

Navigating the landscape of startup financing can be challenging, especially when exploring innovative models like Zero Percent funding. This is where FundFlare comes into play. FundFlare is a pioneering platform that takes the hassle of securing funding for your startup. Their team of experts specializes in connecting entrepreneurs with suitable Zero Percent funding sources, simplifying the application process, and ensuring a smooth journey from inception to funding approval.

FundFlare’s advanced technology and extensive network make it a go-to platform for startups seeking financial support without the burden of interest payments. By leveraging innovative financing models, FundFlare aligns the interests of startups with like-minded funders, creating a supportive ecosystem for success.

In conclusion, as you embark on your entrepreneurial journey in 2024, consider the possibilities offered by Zero Percent funding. Empower your startup with the financial flexibility it needs to thrive, and let FundFlare be your guide in securing the funding you deserve. Launch your dreams confidently and take the first step towards a successful business venture.