By: John Glover (MBA)

In today’s competitive financial landscape, small business owners have more financing options than ever, yet many struggle to access the right funding. Raising capital is critical for growth, covering operational expenses, and keeping a competitive edge, but the path can be daunting, especially for first-time entrepreneurs. JSV Capital has emerged as a valuable partner for small and medium enterprises (SMEs) looking to bridge the gap between ideas and capital by offering flexible solutions and customized lending.

This article explores practical steps for small business owners seeking to raise capital, from understanding funding options to optimizing financial strategies for success with JSV Capital.

1. Identify Your Capital Needs

The first step in raising capital is determining exactly how much money you need and what it will be used for. Broadly, capital requirements fall into two categories: operational capital and growth capital. Operational capital covers day-to-day expenses like payroll, rent, and utilities, while growth capital is intended for larger initiatives like expanding into new markets, buying inventory, or purchasing equipment.

JSV Capital offers tailored solutions, but to make the most of these options, business owners need to articulate their capital needs clearly. Financial advisors at JSV Capital suggest listing anticipated expenses alongside projected revenue to help clarify your short-term and long-term financing needs. This will also improve your loan application, as JSV Capital typically favors businesses with well-thought-out financial plans.

2. Explore Diverse Financing Options

JSV Capital recognizes that every business is unique, and one-size-fits-all lending doesn’t always work. Small businesses have access to various funding channels, each with distinct benefits and risks:

- Term Loans: Traditional loans with set repayment schedules and interest rates, ideal for large, one-time purchases like equipment.

- Business Lines of Credit: Flexible financing that allows businesses to draw funds as needed, only paying interest on what they use—ideal for managing cash flow fluctuations.

- Invoice Financing: For businesses waiting on unpaid invoices, this solution lets you borrow against your outstanding receivables.

- Merchant Cash Advances: Cash advances based on your future revenue, usually requiring daily or weekly repayments. These are convenient for high-revenue businesses with frequent sales transactions.

JSV Capital specializes in term loans and lines of credit, two popular options that provide flexibility and structured repayment. Understanding the nuances of each option can help you make the right choice for your business needs.

3. Strengthen Your Financial Profile

Financial institutions assess risk by examining a business’s creditworthiness, cash flow stability, and growth potential. To improve your chances of securing funding, work on strengthening these areas before applying:

- Optimize Your Credit Score: A healthy business credit score signals reliability to lenders. Paying debts on time and reducing outstanding balances can help boost your score.

- Maintain Accurate Financial Records: Lenders like JSV Capital rely on clear, organized financial data when evaluating loan applications. Regularly updating profit and loss statements, cash flow projections, and tax documents can reflect a transparent and financially responsible business.

- Improve Cash Flow: Lenders evaluate your cash flow to assess repayment ability. Reduce unnecessary expenses and consider negotiating longer payment terms with vendors to optimize your cash flow.

JSV Capital values transparency and encourages businesses to share their financial data openly, as this allows them to provide more customized lending solutions.

4. Prepare a Compelling Business Plan

A well-documented business plan can set your application apart. JSV Capital, like other lenders, looks favorably upon businesses that clearly outline their goals, market positioning, growth strategies, and financial projections. An effective business plan includes:

- Executive Summary: Briefly describe your business, its mission, and growth potential.

- Market Analysis: Shows understanding of your industry, customer segments, and competitors.

- Sales and Marketing Strategy: Outlines how you plan to attract and retain customers.

- Financial Projections: Details expected revenue, profit margins, and operating costs over the next 3-5 years.

JSV Capital advises applicants to include a risk assessment section. Acknowledging potential risks and strategies to mitigate them signals lenders that you are well-prepared and strategic about your business’s future.

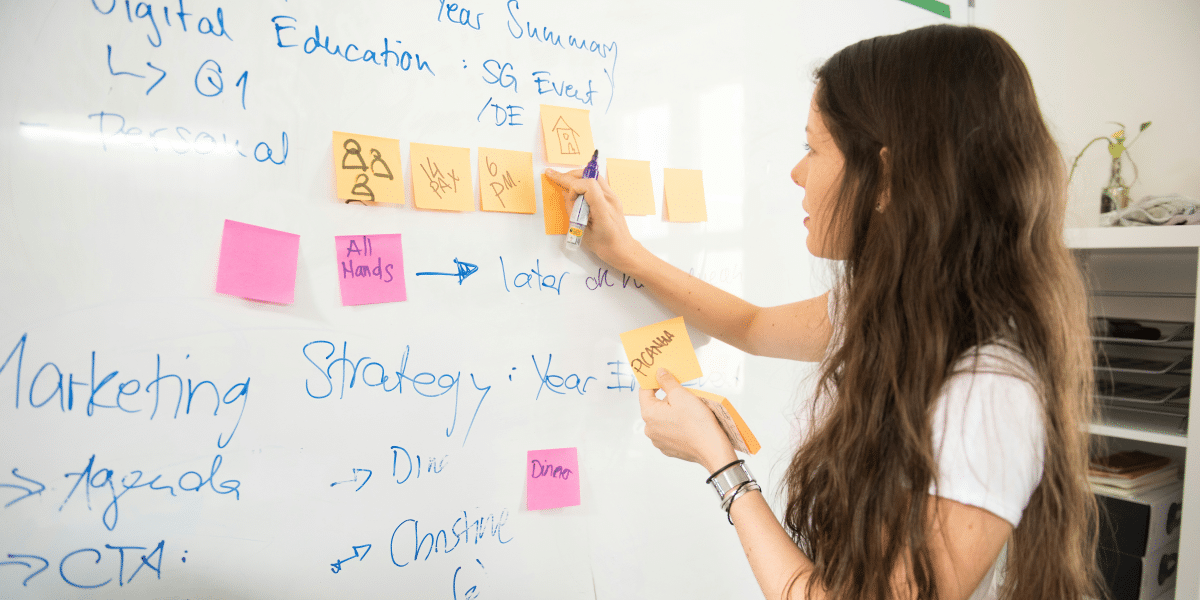

5. Leverage Digital Tools for Financial Management

Financial technology (fintech) tools can significantly contribute to managing and tracking your capital. JSV Capital often suggests using software that helps automate accounting, budgeting, and cash flow projections. With technology integration, lenders can also make faster, data-informed decisions regarding your financing needs.

These tools offer several advantages:

- Real-Time Insights: Track expenses, revenue, and cash flow in real-time.

- Automated Reporting: Save time on manual financial calculations.

- Improved Budgeting: Identify trends and adjust spending to meet financial targets.

By leveraging these resources, businesses can better prepare their finances and present a clear, data-driven picture to potential lenders like JSV Capital.

6. Build a Relationship with Your Lender

Lending relationships are pivotal in business finance. Having a strong relationship with a lender like JSV Capital can offer additional support during challenging times and help secure future funding as your business grows. Here are a few strategies to build trust:

- Stay in Communication: Provide regular updates about business milestones or challenges, even after you’ve secured funding.

- Meet Payment Obligations: Making timely payments builds credibility and opens doors for more flexible financing in the future.

- Request Financial Guidance: JSV Capital offers advisory services that can help optimize your financial approach. Taking advantage of this can enhance your relationship with them and improve your financial health.

JSV Capital’s client-centered approach ensures business owners can access ongoing advice and support, helping them make informed financial decisions.

7. Consider Alternative Financing if Needed

While traditional loans and lines of credit are common, some businesses may find that alternative financing options align better with their goals. JSV Capital can offer guidance on these options, which may include:

- Crowdfunding: Platforms like Kickstarter or Indiegogo allow businesses to raise small amounts from a large number of people, often in exchange for products or equity.

- Equity Financing: Involves selling ownership shares to investors in exchange for capital. Although this dilutes ownership, it can be a viable option for businesses with strong growth potential.

- Government Grants and Subsidies: Certain industries may qualify for government aid. While not always predictable or available, grants can help businesses access capital without incurring debt.

JSV Capital advises small businesses to assess the pros and cons of each funding source to ensure they align with their long-term vision and capacity for repayment.

8. Review and Plan for Future Funding Needs

Capital needs to evolve as a business grows. Securing financing with JSV Capital today doesn’t mean your funding journey ends. Regularly assessing your capital requirements and understanding your business growth stages will prepare you better for future funding rounds.

The current economic environment can affect capital availability, so planning ahead with a trusted lender like JSV Capital can help you navigate changing conditions. Businesses that proactively assess their finances and financing options position themselves to capitalize on new opportunities as they arise.

Final Thoughts

Raising capital is one of the most important and often challenging steps in the journey of any small business. While the path to financing may be complex, choosing a partner like JSV Capital that understands your specific needs can simplify the process and increase your chances of success. By taking a strategic approach—defining your needs, strengthening your financial profile, and building a strong lender relationship—small business owners can access the capital they need to achieve sustainable growth. Learn more at https://JSVCapital.com.

Disclaimer: This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

Published by: Khy Talara