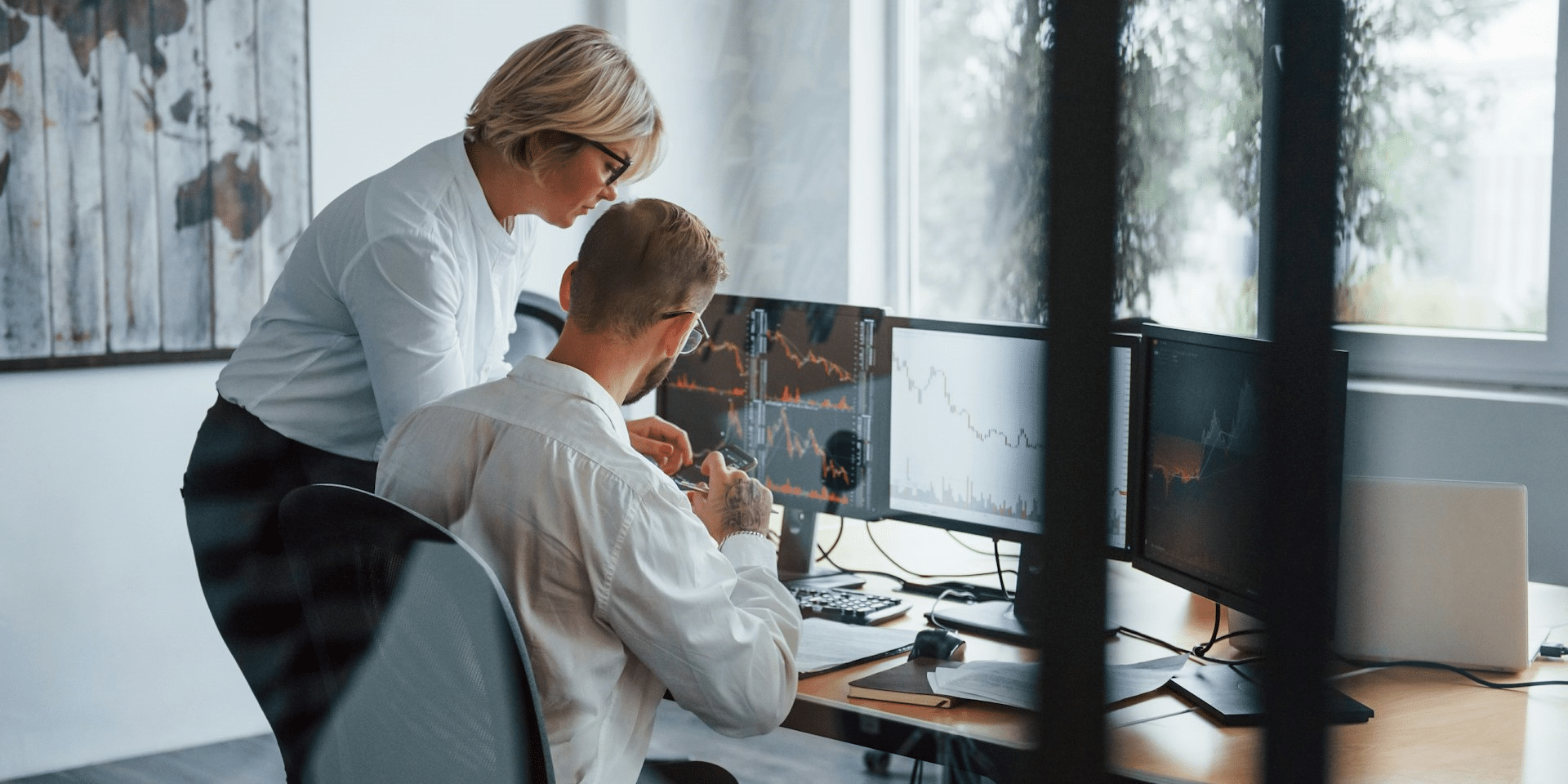

As we move through 2024, Wall Street’s stock market predictions have become a focal point for investors, analysts, and financial institutions alike. These predictions play a crucial role in shaping investment strategies, informing market expectations, and guiding economic forecasts. This article delves into how early stock market predictions for 2024 have fared on Wall Street, exploring the accuracy of these forecasts and the factors influencing their outcomes.

The Role of Stock Market Predictions

Stock market predictions are vital tools for investors looking to navigate the complexities of financial markets. These predictions, often made by analysts and economists, are based on various factors, including economic data, corporate earnings, geopolitical events, and monetary policy. For Wall Street, accurate predictions can mean the difference between significant gains and substantial losses.

Early Predictions for 2024: A Mixed Bag

As 2024 began, several prominent financial institutions made their stock market predictions, with varying degrees of optimism. These predictions focused on key indices such as the S&P 500, Dow Jones Industrial Average (DJIA), and Nasdaq, among others.

Bullish Sentiments

Some institutions, including Goldman Sachs and Bank of America, initially set optimistic targets for the S&P 500, predicting it would reach as high as 5,000 by the end of the year. These bullish predictions were based on expectations of declining inflation, a potential shift in Federal Reserve policy towards rate cuts, and resilient corporate earnings. The underlying assumption was that the U.S. economy would avoid a significant recession, allowing for continued market growth.

Bearish Concerns

However, not all predictions were as optimistic. Some analysts warned of potential market volatility due to lingering inflationary pressures, geopolitical tensions, and the possibility of a recession. These bearish predictions suggested that the S&P 500 could experience significant fluctuations, with some forecasting a range-bound market where gains would be limited.

Factors Influencing Stock Market Predictions

Several factors have played a crucial role in shaping the accuracy of early stock market predictions for 2024:

1. Inflation and Monetary Policy

Inflation has been a major concern throughout 2024. While some early predictions anticipated a rapid decline in inflation, the reality has been more complex. Although inflation has moderated from its peaks, it remains a significant factor influencing market behavior. The Federal Reserve’s response, including interest rate hikes and potential cuts, has been closely watched, with its decisions impacting market sentiment and stock valuations.

2. Corporate Earnings

Corporate earnings have also played a pivotal role in determining the accuracy of stock market predictions. Many early forecasts were based on the expectation of strong earnings growth, driven by resilient consumer demand and cost-cutting measures by companies. While some sectors have met or exceeded these expectations, others have struggled, leading to mixed results across the market.

3. Geopolitical Risks

Geopolitical risks, including tensions in Eastern Europe and trade disputes, have introduced additional uncertainty into the markets. These risks have often led to sudden market fluctuations, challenging the accuracy of early predictions and prompting revisions from analysts.

How Have Predictions Fared So Far?

As we approach the latter half of 2024, it’s clear that early stock market predictions have had mixed success. While some of the bullish forecasts, particularly those anticipating a gradual decline in inflation and steady economic growth, have been validated by recent market performance, others have fallen short due to unforeseen challenges.

Successful Predictions

Predictions that emphasized the resilience of certain sectors, such as technology and healthcare, have generally fared well. These sectors have continued to perform strongly, driven by innovation and sustained demand. Additionally, forecasts that anticipated a cautious but stable Federal Reserve policy have been largely accurate, as the Fed has taken a measured approach to interest rate adjustments.

Missed Targets

On the other hand, some predictions have missed the mark, particularly those that underestimated the persistence of inflationary pressures or the impact of geopolitical events. These factors have led to greater market volatility than initially expected, causing some of the more optimistic targets for indices like the S&P 500 to be revised downward.

Lessons Learned from 2024 Predictions

The experience of 2024 highlights the inherent challenges of making accurate stock market predictions. While economic models and historical data provide valuable insights, the unpredictable nature of global events and market sentiment can often lead to unexpected outcomes.

The Importance of Flexibility

For investors, the key takeaway is the importance of flexibility and adaptability. Rigid adherence to early predictions can lead to missed opportunities or unnecessary risks. Instead, a dynamic approach that incorporates new information and adjusts strategies accordingly is essential for navigating the complexities of the stock market.

Continued Monitoring and Analysis

Ongoing monitoring of economic indicators, corporate earnings, and geopolitical developments is crucial for staying ahead of market trends. By staying informed and ready to pivot, investors can better manage their portfolios in response to changing conditions.

Early stock market predictions for 2024 have provided valuable guidance for investors, but they have also faced significant challenges. As the year progresses, the interplay between inflation, corporate earnings, and geopolitical risks will continue to shape market outcomes. For Wall Street, the lessons learned from these predictions underscore the need for a flexible, informed approach to investment strategy.